.

The content displayed on this page is intended for guidance purposes only. It is not exhaustive and is constantly being updated to refelect the latest changes. To stay up to date, we advise you to visit this page frequently.

About critical Security & Safety Changes

Changes to customs regulations and VAT obligations come into effect throughout 2021, affecting B2C e-commerce sellers and marketplaces both in and outside the EU.

As of March 15 2021, new safety and security regulations (dubbed Import Control System 2, or ICS2) apply within the EU. Consequently, the consignment data and content information required for export and import must be entered electronically by the sender and sent to the country of destination in advance (electronic advance data – “EAD”).

Taking into account the growth of global cross-border e-commerce, the new regulations are intended to provide greater security and quicker customs processes.

What is ICS2?

ICS2 is a large-scale EU information system enabling customs authorities to carry out targeted risk assessments based on pre-declaration data (Entry Summary Declaration – ENS) prior to the arrival of goods in the EU.

It allows customs authorities to identify high-risk consignments (for example, dangerous goods or weapons) which might require presentation and control earlier in the supply chain.

What are the ICS2 releases?

ICS2 will be implemented in several phases:

![]()

15.03.2021

Courier and postal transport (Air Express & Postal Air pre-loading)

The electronic Entry Summary Declaration (ENS) will be mandatory for all express and postal consignments destined for the EU, Norway and Switzerland.

![]()

01.03.2023

Air freight transport

In addition to pre-loading filing requirements, all postal, express and general cargo consignments transported by air will be subject to pre-arrival ENS data requirements.

01.03.2024

Rail, road and maritime transport

Maritime, road and rail carriers will have to submit ENS data to ICS2. This includes postal and express carriers who transport goods using these modes of transport as well as other parties, such as logistics providers. In certain circumstances, final consignees based in the EU will also have to submit ENS data to ICS2.

What does it mean?

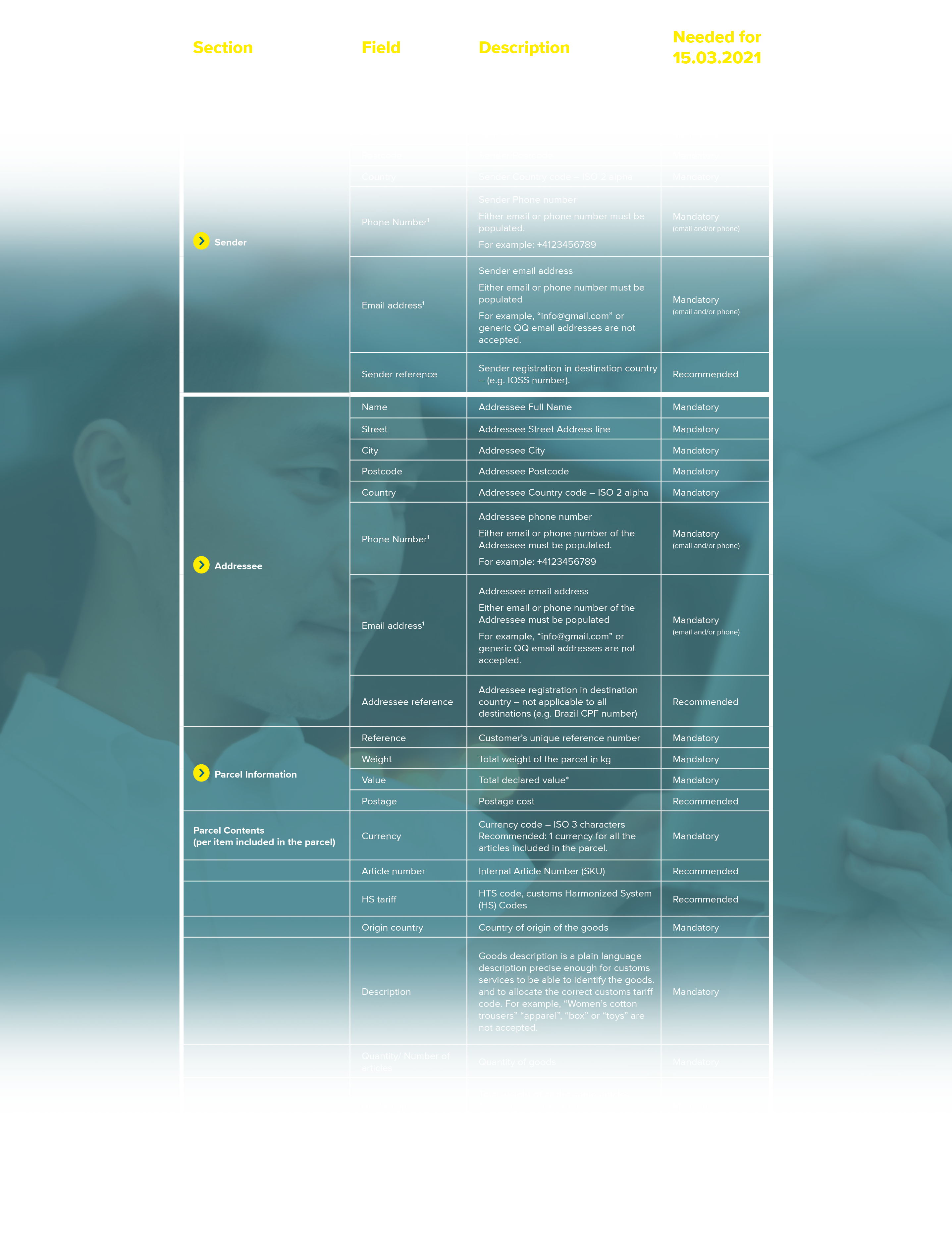

A minimum electronic dataset must be provided. This dataset will be included in the Electronic Advance Data (EAD). For a full list of the dataset View the Electronic Advance Data requirements

The requirement to submit electronic data (ENS) prior to the arrival of goods applies to EU destinations, Switzerland and Norway. Currently, the UK is not subject to the advance notification.

All Details on the European Commission's official Page

https://ec.europa.eu/taxation_customs/general-information-customs/customs-security/import-control-system-2-ics2/

EAD refers to the electronic transmission of data concerning sender, recipient, consignment content and shipment. Since January 1 2021, the consignment and content data of items being exported (including letter mail containing goods up to 2 kilograms) is entered electronically and transmitted to the country of destination in advance.

.png?width=500&name=Asendia-Customs-3d%20(1).png)